We here at Human Element have opinions about many things. (I mean, have you read our previous posts about the future of eCommerce and payment methods?) More than that, though, our team members know a lot about what’s happening in the world of eCommerce and all things tech.

This time for our quarterly roundtable we tackled the eCommerce behemoth, Amazon. Love it (it’s easy! quick! convenient!) or hate it (it’s destroying small businesses! the UX is terrible! the environmental impact is a huge problem!), it’s not going anywhere anytime soon.

In this discussion, our team – consisting of marketers, strategists, and a developer – touched on broad issues, from Amazon’s evolving role in eCommerce to the impact of AI, privacy concerns, and the future of the platform. Here’s a closer look at those themes.

Amazon Today

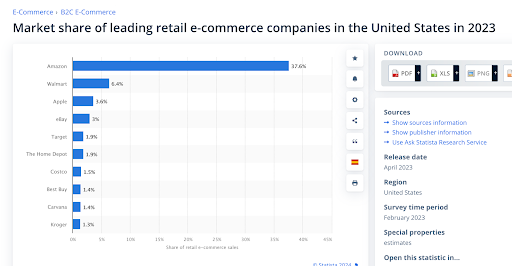

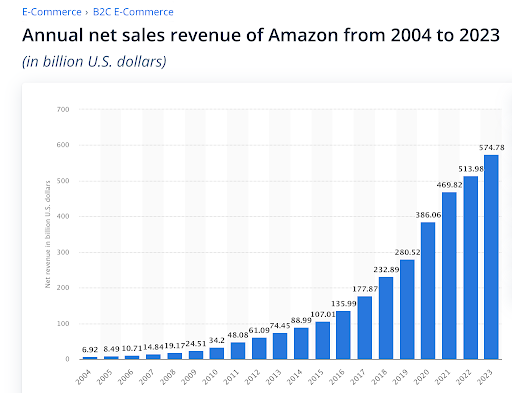

The Amazon shopping experience of today is certainly different from when it first started way back in the 90’s, but it’s even much different from where it was just a few years ago. The COVID-19 pandemic boosted the platform higher than it already had been. eCommerce-savvy consumers and slow-to-adopt eCommerce consumers alike flocked to the retailer to buy goods online, which ballooned Amazon’s market share (and Jeff Bezos’ bank account).

And while sales on Amazon grew exponentially, the customer experience suffered. When you sell everything, it’s nearly impossible to organize products in a way that makes sense. Finding a variety of results in a product search is a problem; there are often only one or two versions of a product listed under thousands of different brand names. And website navigation with so many product categories is cumbersome. Our team members remarked on the unpleasant shopping experience by saying, “I just go there to get what I need and get out. I have no desire to browse.”

There once was a time when shopping on Amazon was fun, even delightful, discovering new products you never knew you needed. Now it feels like walking down the Vegas strip with all its glaring lights, noise, and distraction. Where do you look first?

Another theme in our discussion was how Amazon Prime may continue to expand its benefits, but the core benefit—fast, reliable shipping—is no longer reliable. We’re frustrated with delayed Prime shipping, which used to be a hallmark of the service. As one participant remarked, “Prime used to be guaranteed two-day delivery, and now that is just not happening consistently. What are we paying for?”

Where is Amazon Headed?

Some of our team would like to see Amazon’s monopoly power dismantled, but the majority of the group thinks that won’t happen. Amazon’s future in eCommerce seems secure, but the platform is evolving rapidly. While Amazon remains the dominant player in eCommerce, competitors like Google and Microsoft are slowly chipping away at its market share in cloud computing. At the same time, Amazon will look to expand into new industries, such as insurance, healthcare, and medical products, as it seeks to diversify its business.

Additionally, Amazon’s move into hardware, such as AI-powered home assistants and humanoid robots, remains a topic of debate. One roundtable participant feels strongly that Amazon mostly fails when it comes to tech products (see: Fire Phone and Alexa; the Kindle being the one exception). Still another panelist is convinced it will push the boundaries of what’s possible with AI and robotics, saying “Amazon will develop an advanced humanoid robot assistant for your home.” If that’s true, we’ll come back to you later with another blog post about whether we think it was all worth it.

The Role of AI and Robotics

Artificial intelligence (AI) is already deeply integrated into Amazon’s operations, from its customer service tools to its logistics network. Amazon uses its Rufus platform to recommend products, answer customer questions, and optimize shipping routes. But where is AI heading next?

The way we see it, Amazon could leverage AI to help improve their site and service by helping customers to get to the right products even faster, finding new ways to organize and present their gigantic product catalog, and getting better at recommending products based on customer purchase history or through other data gathered from other smart devices. We also hope they use it to make reviews and recommendations more relevant and less spammy.

The discussion also led to ideas about how Amazon’s AI might evolve, particularly with the development of humanoid robots. One participant suggested that such a robot might eventually handle tasks such as reordering groceries or performing basic household chores. However, there are significant privacy concerns associated with AI-driven products, especially as these technologies become more deeply embedded in consumers’ lives.

The Privacy Problem

With increased AI integration comes the risk of eroding privacy. Amazon’s data-driven business model relies heavily on gathering personal information, from shopping habits to household behavior through devices like Alexa. As one roundtable participant pointed out, “Our privacy is being eroded away, and it’s becoming non-existent with AI-powered devices.”

The group discussed how Amazon’s AI systems could become more invasive as they collect more data to provide personalized experiences. While this may improve convenience, it also raises ethical questions about how much data consumers are willing to give up in exchange for efficiency. Think about that potential humanoid robot we talked about earlier, and the implications of having a device like that in your home, tracking all of your activities and preferences and delivering that data back to Amazon. Is that really OK? How do we balance convenience and privacy in these situations?

The Recent “Back to Office” Mandate

With the recent announcement by Amazon’s CEO, Andy Jassy, that he is going to require corporate workers to return to the office five days a week, we had to wonder how this might impact Amazon overall. With the proposed goal of operating “like the world’s largest startup,” perhaps the team at Amazon will regain some of its innovative ways, a product of collaborating in person and realizing efficiencies by dropping unnecessary meetings.

But our team is skeptical, believing that this move is a secret layoff and is correcting its hiring spree from 2021 and 2022. We predict most of the best talent will exit the company, accustomed to the more time-, budget-, and family-friendly benefits of working remotely. (The news is bearing that theory out, too.) The workloads of those who stick it out, though, will likely increase and lead to possible burnout.

Competing with Walmart: Amazon’s Battle in the Physical World

Amazon’s competition with Walmart came up frequently during the discussion, particularly in the context of logistics. Walmart’s aggressive expansion of its grocery and delivery services has made it a serious contender, especially in rural and suburban markets. One participant mentioned how Walmart’s ability to deliver groceries within hours has given it a competitive edge in areas where Amazon’s distribution network struggles.

Despite Amazon’s acquisition of Whole Foods, the platform has been slow to dominate grocery delivery in the same way Walmart has. This presents a potential weakness in Amazon’s strategy, especially as grocery delivery becomes a more critical part of the eCommerce landscape.

Fraud and Security Concerns

Security issues on Amazon were another major topic of discussion. The platform has experienced a rise in fraud, particularly with hackers gaining access to accounts and using them to commit fraud. One participant shared an anecdote about a family member whose account was hacked, allowing fraudsters to make purchases and sell the resulting gift cards.

While Amazon has implemented some security measures, such as biometric logins and two-factor authentication, the roundtable revealed concerns about whether these measures are enough. As one participant noted, “The amount of fraud happening on Amazon is negligible to the amount of money they make, but at some point, it’s going to catch up with them.”

What Does Amazon Mean for the Future of eCommerce?

While Amazon is undoubtedly a giant in eCommerce, its dominance is being challenged in new and unexpected ways. The rise of other platforms, the growing importance of direct-to-consumer (DTC) models, and the evolving nature of online shopping mean that Amazon may not always be the default choice for consumers.

Participants discussed how local businesses are increasingly setting up their own Shopify stores, allowing them to compete with Amazon on convenience and customer experience. As one participant put it, “Local businesses are realizing they need to be as convenient as Amazon to compete.” This shift may signal a broader trend toward decentralization in eCommerce, with more brands choosing to sell directly to customers rather than relying on marketplaces like Amazon.

And that leads to…

Up Next: What Merchants Should Consider When Planning to Sell on Amazon Marketplace

Our discussion on Marketplace deserves its own blog post, as we consider what to recommend to merchants who ask whether or not they should consider selling there. Our short, stock answer: “It depends.” Stay tuned for the next post in this series that will walk you through the benefits and shortfalls of selling on Amazon.